Mortgage Blog

Getting you the mortgage you deserve

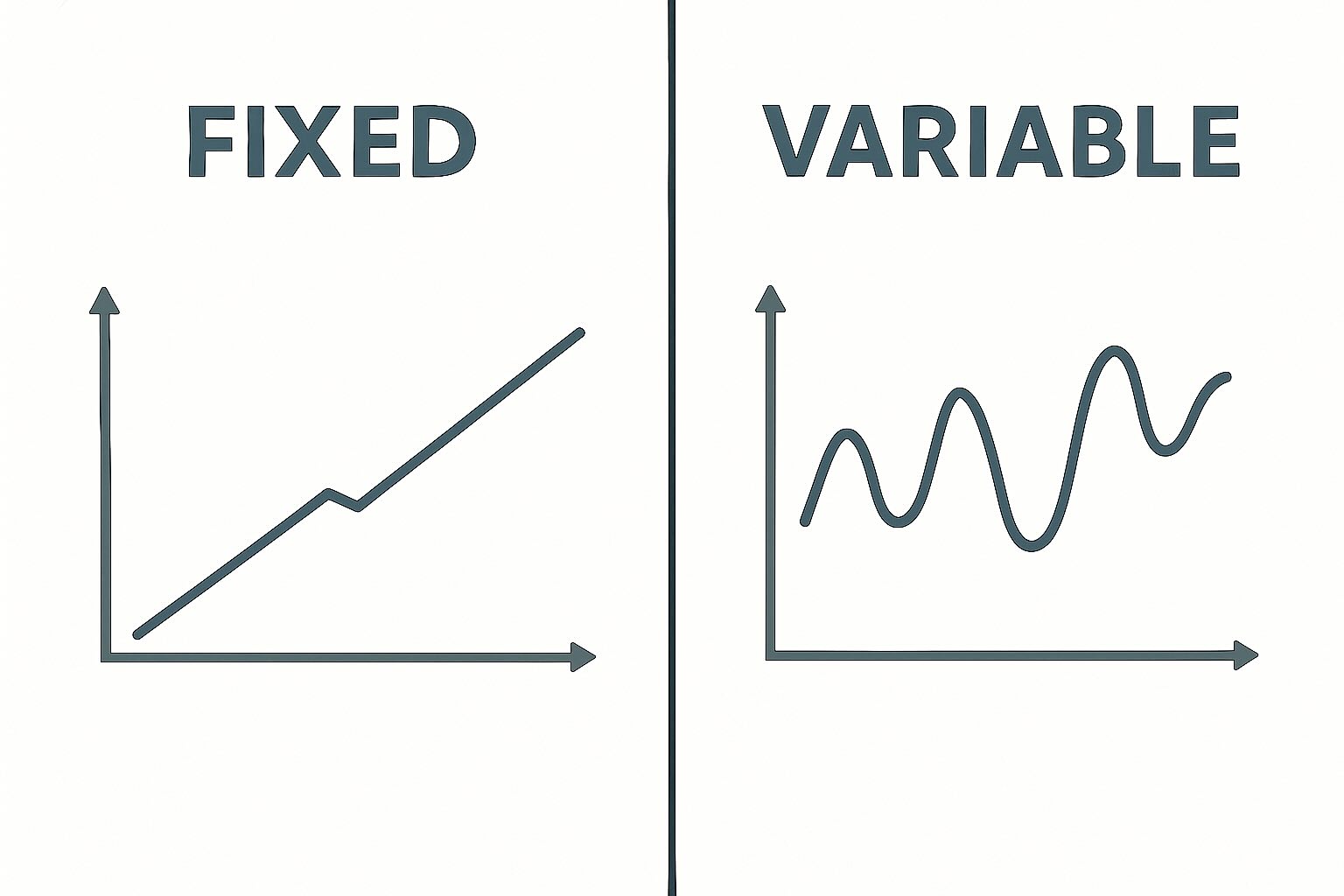

Variable vs. Fixed: What’s Going On Right Now?

August 26, 2025 | Posted by: Assured Mortgages

When you're choosing a mortgage, one of the biggest decisions is whether to go with a fixed rate or a variable rate. The truth? Both options can work- it depends on your comfort level, budget, and future plans. Here's a guide to help you choose with confidence.

Fixed Rate Mortgages

Pros:

- Your rate and payments stay the same for the term.

- Easier to budget — no surprises.

- Peace of mind if you don’t like risk.

Cons:

- Rates are often a bit higher than variable.

- If you break your mortgage early, penalties can be steep.

Variable Rate Mortgages

Pros:

- Usually start lower than fixed rates.

- You can often switch to a fixed option later without penalty.

- If rates drop, you save money.

Cons:

- Payments can increase if rates go up.

- Harder to plan a tight monthly budget.

How to Decide: A Simple Guide

1. Start with Your Comfort Level

Ask yourself: Do I sleep better knowing my payments won't change? If yes, go fixed. If you are okay with some movement to save money, a variable could be right for you.

2. Think About Your Budget

If your budget is tight and stability matters, fixed helps. If you’ve got some wiggle room, variable may work.

3. Look at Your Timeline

Staying in your home for the long haul? Fixed gives predictability. Expecting changes (moving, refinancing, upsizing)? A shorter fixed or a variable keeps things flexible and can reduce penalties.

4. Watch the Market (But Don’t Overthink It)

Rates are expected to gradually come down over the next few years. That meansa variable could save you money, but fixed rates already reflect some of those cuts. It’s about choosing what feels right for you.

5. Run the Numbers

Even a small difference in rates changes your payments. Let’s compare side by side so you see the impact clearly.

Bottom Line

You’re not just picking a rate — you’re choosing peace of mind, flexibility, or potential savings. The right choice depends on you. At Assured, we’ll walk you through both options and make sure you land on a strategy that fits your life, not just today’s market